The composition of the Board of Directors of the Bank is governed by the provisions of the Companies Act, 2013, the Banking Regulation Act, 1949 and the listing requirements of the Indian Stock Exchanges where the securities issued by the Bank are listed.The Board of Directors are the highest governance body and comprise of renowned individuals with vast experience in public policy, administration, industry and commercial banking.

Directors as on March 31, 2019

- Executive Directors

- Non- Executive Directors

- Independent Directors

1. Mr. Aditya Puri

(Managing Director)

2. Mr. Kaizad Bharucha

(Executive Director)

1. Mr. Keki Mistry

2. Mr. Srikanth Nadhamuni

1. Mrs. Shyamala Gopinath

(Part-time Non-Executive Chairperson)

2. Mr. Malay Patel

3. Mr. Umesh Chandra Sarangi

4. Mr. Sanjiv Sachar

5. Mr. Sandeep Parekh

6. Mr. M.D. Ranganath

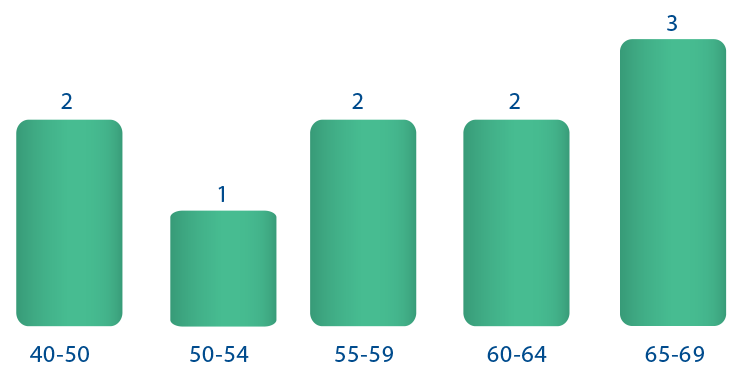

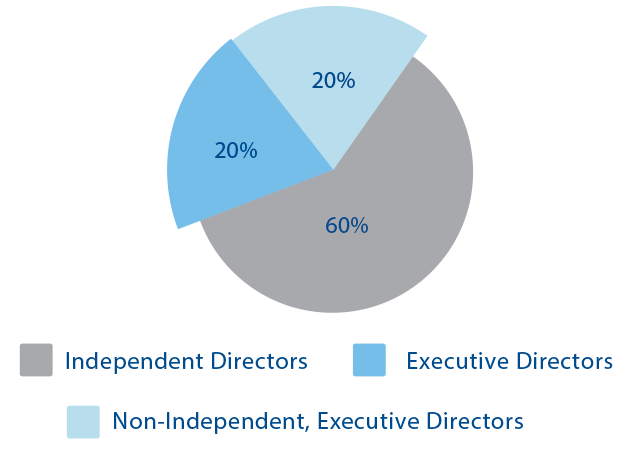

As on 31st March 2019, the Board comprises of 10(ten) Directors including 1(one) woman Director. The composition of committees of Directors, age group of Directors and the Board composition is depicted below

Age Group of Directors - No. of years (Y)

Board Composition

Board Performance

Evaluation

The Nomination and Remuneration Committee (NRC) has approved a framework / policy for the evaluation of the Board, the Committees of the Board and the individual members of the Board (including the Chairperson), which is reviewed annually by the NRC.

Questionnaire Designed

For Evaluation

A questionnaire for the evaluation of the Board, it Committees and the individual members of the Board (including the Chairperson), designed in accordance with the said framework and covering various aspects of the performance of the Board and its Committees.

Assessment Of The

Independent Directors

The assessment of the Independent Directors, on the performance of the Board and its Committees was subsequently discussed by the Board at its meeting.

Evaluation By

Independent Directors

The responses received to the questionnaires on evaluation of the Board and its Committees were placed before the meeting of the Independent Directors for consideration.

Responses

Received

Questionnaire sent out to the Directors.

Policy on Appointment and Remuneration of Directors and Key Managerial Personnel

The NRC recommends the appointment of Directors to the Board. The remuneration of whole time Directors is governed by the compensation policy of the Bank. The same is available at the weblink https://www.hdfcbank.com/aboutus/cg/codes-and-policies.htm

Ratio of remuneration of each Director to the median employees’ remuneration for FY 2018-19 :

| Designation | Ratio |

| Managing Director | 248:1 |

| Executive Director | 109:1 |

| Note : For further details on Corporate Governance, Board of Directors and their functioning, on please refer Annual report FY 2018-19. |

Corporate Governance Framework

The Bank has proactively upheld good governance practices and is constantly striving to enhance its standards. The Board of Directors is accountable to various stakeholders of the Bank and is the ultimate custodian for observing good governance practices. It is responsible for setting course and evaluating the Bank’s performance in corporate governance.

The parameters of evaluation include compliance, internal control, risk management, information and cybersecurity, customer service, social & environmental responsibility.

For any queries or questions

regarding the report or its contents,

contact:

Nusrat Pathan

Head, Sustainability & Corporate Social Responsibility

HDFC Bank Limited

Nusrat.Pathan@hdfcbank.com

All Rights Reserved.