Digitisation is of paramount importance for the Bank. The Bank continues to evolve with the fast-changing customer preferences and market conditions. It continues to position itself for future growth, keeping innovative processes and programs as a priority.

The Bank has given shape to its digital vision, with the focus to launch customer-centric products and services.

The Bank continues to stay ahead of its peers on the digital innovation front and is investing in cutting edge digital technology to provide seamless solutions to its customer.

The Bank has been recognised as the ‘Best Digital Bank’ in India at the Asiamoney’s Best Bank Awards 2019. Through it’s digitalisation initiatives, the Bank aligns to SDG 9 (Industry, Innovation and Infrastructure) and SDG 11 (Sustainable Cities and Communities)

Centre of Digital Excellence

Centre of Digital Excellence (CODE) is an initiative by the Bank to adopt best practices in the digital space and enrich the experience of their offerings to customers. The purpose of CODE is to identify, induct, train, deploy and launch various digital initiatives to equip the Bank’s employees with necessary resources to build better solutions for customers. It is a dedicated organisational structure for carrying out all digital initiative across the Bank.

CODE has many elements - Industry Academia, Digital Innovation Summit and Digital Command Centre, Accelerators Engagement Program that reflect the partnerships and domain expertise shared by the Bank with important stakeholders like educational institutions, start-ups and fintech companies to enhance its digital banking capabilities, which eventually benefits customers.

Moving towards Digital 2.0

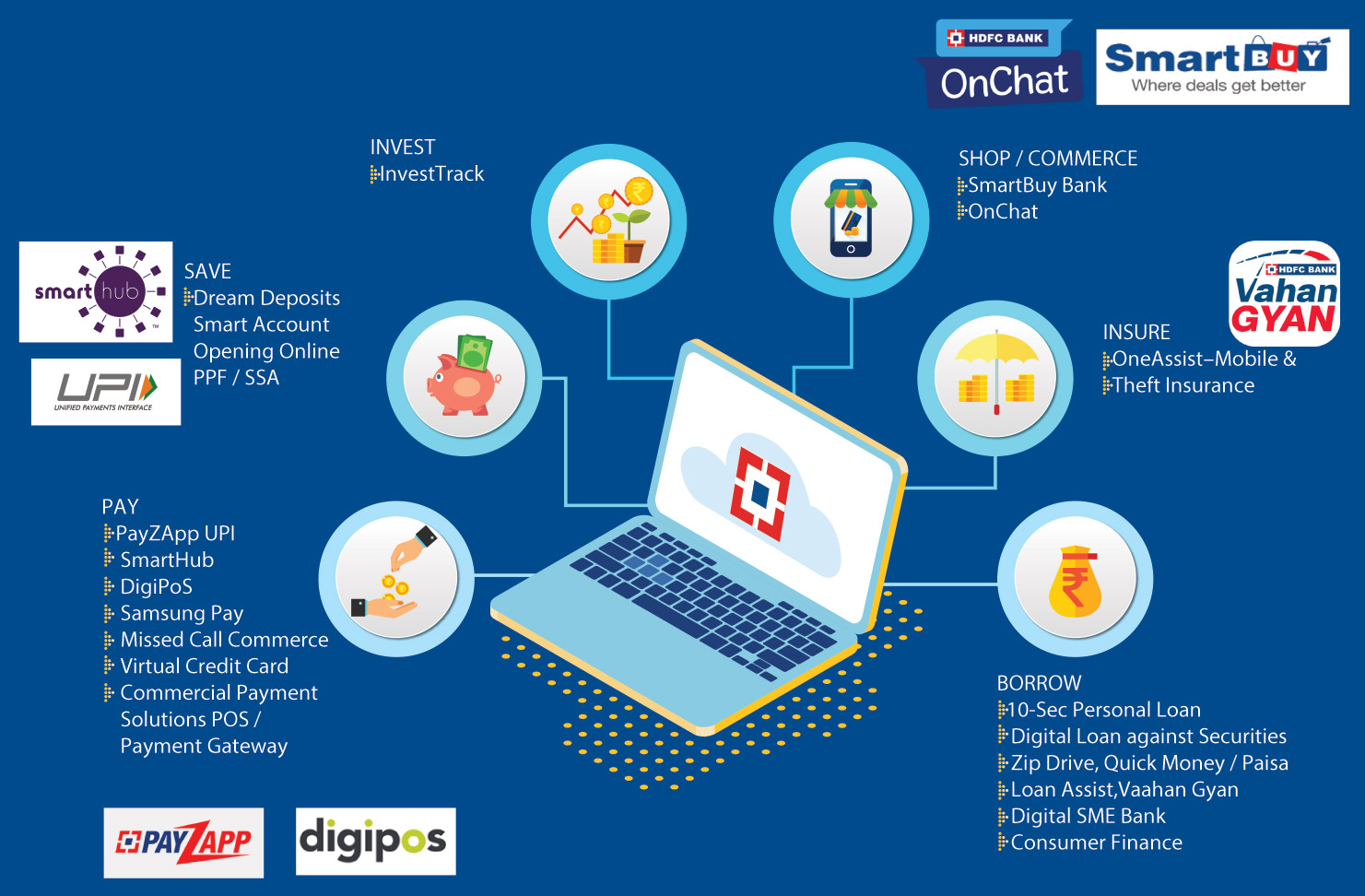

The Bank is a pioneer in the era of digital banking. It has created platform capabilities that support lending, payments and transactions, to developing in-house skills required to excel in a digital-driven world. This has resulted in offerings like, 10-second loans and Missed Call Banking which have been developed in-house. The Bank has paved its way for Digital 2.0.

The key elements of the Digital 2.0 strategy are:

Reimagined Customer Interface

Digital Analytics, Digital Acquisition and Digital Marketing

Digital Innovation

API Banking

VRM (Virtual Relationship Manager)

For details kindly refer to the Annual Report FY 2018-19. HDFC Bank Annual Report FY 2018-2019

Digitisation today touches almost every part of people’s lives and the Bank has recognized this to be a fundamental shift impacting customer behaviour. The Bank is hence shifting its strategy to offer customers a differential experience from a purely transactional approach.

For any queries or questions

regarding the report or its contents,

contact:

Nusrat Pathan

Head, Sustainability & Corporate Social Responsibility

HDFC Bank Limited

Nusrat.Pathan@hdfcbank.com

All Rights Reserved.